Business valuations and the control premium controversy

Within business valuations, the control premium story changed over thirty years ago, but the application of control premiums still appears to be a controversial matter. The old story The business valuation control premium story use to go something like this… The...

How to value a start-up?!

Valuing a start-up or young company can be problematic. Key problems can include: little or no financial history dependency on key people to make it a success requires private capital to survive making little or no revenue and likely loss making Another key issue is...

Business valuation – discount and premium controversies

Within the business valuation profession, discounts and premiums are an ongoing source of controversy. But why? What are discounts and premiums? Firstly, what are discounts and premiums? The International Valuation Standards state that: "In the market approach, the...

FME RIP – The demise of a business valuation method?

The 2025 updated International Valuation Standards were issued earlier in the year and, as ever, the FME business valuation method is no where to be seen.* What has happened to the beloved FME business valuation method? Has it expired, passed on, ceased to be? Why no...

Business Valuation Approaches and the International Valuation Standards

The International Valuation Standards (IVS) provide some very helpful guidance on the three key Valuation Approaches and the application of those approaches to the valuation of businesses and business interests. Guidance is provided in both the specific Business...

What the ATO expects to see in a business valuation report and where the IVS can help

The ATO provides comprehensive guidelines about who can prepare and what the Commissioner expects to see in a business valuation report for tax purposes. Can the International Valuation Standards (IVS) be helpful in meeting the Commissioner's expectations? Who can...

Valuing a minority interest in a private company

A minority investor in a privately held company, brings to my mind being stuck in the mud! It is likely to be a slow process finding a buyer and there is probably little they can do to influence cash flows. Coincidentally, valuing a minority interest in a privately...

2025 International Valuations Standards

The updated International Valuation Standards (the Standards) were published in January 2024 and apply to all valuations from 31 January 2025. The updated Standards introduce some fundamental changes, including an expanded Glossary, new mandatory requirements, new...

Estimating an illiquidity discount using option modelling

An investor in a public company can sell their shares instantaneously. In comparison it usually takes time for an investor in a private company to find a buyer and exchange contracts. According to the Pepperdine 2023 Private Capital Market report, business brokers...

Pepperdine Survey 2023: What are the current favorite valuation methods & multiples?

The 2023 Pepperdine annual private cost of capital survey is just out! The survey captures the current views and behaviour of finance professionals, including, Private Equity (PE) firms, business brokers and business appraisers. This year while only sixty four brokers...

The impact of ESG scores on the cost of capital and leverage

A recent paper by Randy Priem and Andrew Gabellone analyses the relationship between ESG scores and the observed cost of capital of six hundred European-based companies. The research examines the impact of the individual components of ESG on the cost of equity, beta...

Valuing private companies Part 2: Quantifying illiquidity

Compared to a hypothetical diversified investor in a public company, a hypothetical controlling investor in a private business can potentially suffer from two key disadvantages: reduced opportunity to diversify away unsystematic risk; the business may be their main...

Valuing private companies Part 1: Quantifying systematic and unsystematic risk

Compared to a hypothetical diversified investor in a public company, a hypothetical investor in a private business can potentially suffer from two key disadvantages: reduced opportunity to diversify away unsystematic risk; the business may be their main investment a...

ATO valuation reports: common issues

The ATO sets out comprehensive requirements of what is expected in a valuation report. These requirements include that the report is understandable, replicable, reasonable and defensible. But what are some of the issues the ATO encounters with valuation reports?...

Building Knowledge Series

AU | Forensic Accounting: Quantifying damages in breaches of contract Event hosted by Chartered Accountants Australia and New Zealand March 10, 2021 – 7:30 AM - 8:30AM Waterfront Place, Waterfront Place 1 Eagle Street Register Now About this event In breaches of...

Valuing businesses and applying control premiums

The market share price of a listed public company represents the portfolio interest price. That is to say, the price an investor is prepared to buy or sell a small parcel of shares, typically less than 5% of the company. In takeovers of listed companies, an acquirer...

Valuing a privately-held business: measuring illiquidity

The value of a privately-held business maybe calculated using a discounted cash flow method or a capitalisation of earnings method; both methods require an estimate of the cost of capital. The cost of capital can be estimated using pricing from public markets. Shares,...

Business interruption claim and lost profit

Lost profit is generally defined as the revenue the injured party would have made, but for the business interrupting event, less the costs saved. According to Niamh Brennan and John Hennessy (1) the lost profit computation can be broken into the following steps: 1....

Should I use the Capitalisation of Excess Earnings Method to value a business?

I wondered if I should be using the Capitalisation of Excess Earnings method to value a business? The method originated in 1920 in the US, from a Treasury Department memorandum and later update as an Internal Revenue Service (IRS) Revenue Ruling. During prohibition,...

2019 Pepperdine Private Capital Markets survey

The Pepper Private Capital report was recently released. I’ve saved you the trouble and ploughed through it! I personally wouldn’t want to rely on it for valuation inputs (its US based anyway) but it might be an interesting sanity check (or not!). These are the bits...

Factors affecting the Equity Risk Premium

Risk-averse investors demand a higher rate of return on an average equity risk investment compared to a risk-free investment. The difference in return is the Equity Risk Premium (ERP). ERP is the price of risk. What, however, are the factors that influence the ERP?...

Business valuations: applying a small-cap premium?

Often business valuers use a higher required equity return for a small business compared to a similar, but larger business. The difference in equity returns is the small-cap premium. It refers to the premium small capitalised businesses (a low market value) are...

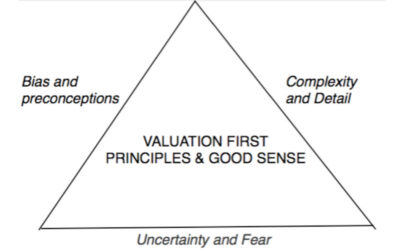

The Bermuda triangle of valuations — “where valuations go to die”

I like Professor Damodaran’s simple Bermuda triangle of valuations. According to the Professor, the three simple truths of valuation (the sides of the triangle) are: All valuations are biased. You just need to think about how you are biased and by how much. Be aware...

Business valuation and risk

risk /rɪsk/ — a situation involving exposure to danger, from Italian risco “danger” Business value is a function of the future expected cash flows from the business and the risk attached to those cash flows. The value of a business is the present value of future cash...

Marketability Discounts

Marketability discounts are often applied by business valuation experts to reflect the difficulty in selling shares in a private business compared to selling shares in a publically listed company. You can sell shares in a listed stock at the click of a button, with a...

Art for art’s sake. Money for God’s sake!

The similarities between valuing and selling a business and valuing and selling art. Leonardo da Vinci’s Salvator Mundi (“Saviour of the World”) was sold last year for $450 million. $450 million! Only sixty years earlier the painting sold for just $60. Can there be...

Earnings multiple and business valuation

An earnings multiple may be used to provide a guide to the valuation of a business. The relevant earnings base is multiplied by the earnings multiple to arrive at the business valuation. The earnings multiple reflects the risk attached to future earnings. The lower...

Expert evidence

\ ˈek-ˌspərt — expert Having, involving, or displaying special skill or knowledge derived from training or experience. \ ˈˈe-və-dən(t)s — evidence Information drawn from personal testimony used to establish facts in a legal investigation or admissable as tesimony in a...