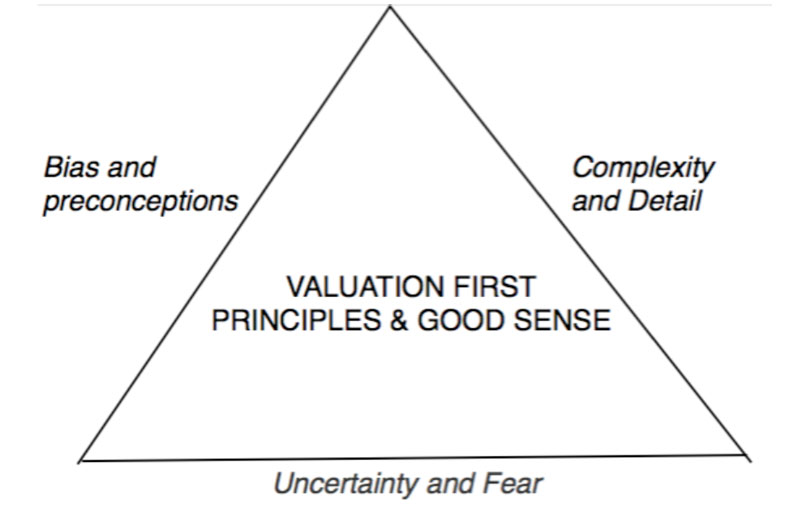

I like Professor Damodaran’s simple Bermuda triangle of valuations.

According to the Professor, the three simple truths of valuation (the sides of the triangle) are:

All valuations are biased. You just need to think about how you are biased and by how much. Be aware of your preconceptions. There is no true value.

Valuations are not precise. They involve uncertainty. The more uncertainty, the more insight you can bring as a valuer. Don’t be afraid to embrace uncertainty.

The more complex a model the further you move from reality. Your understanding of the valuation model is inversely proportionate to the number of inputs! Who is controlling the valuation, you or the model?! Keep it simple.

Simon is a Chartered Accountant Business Valuation specialist. Simon specialises in providing valuation services. Simon provides valuation services in disputes, for raising finance, for restructuring, transactions and for tax purposes.