The similarities between valuing and selling a business and valuing and selling art.

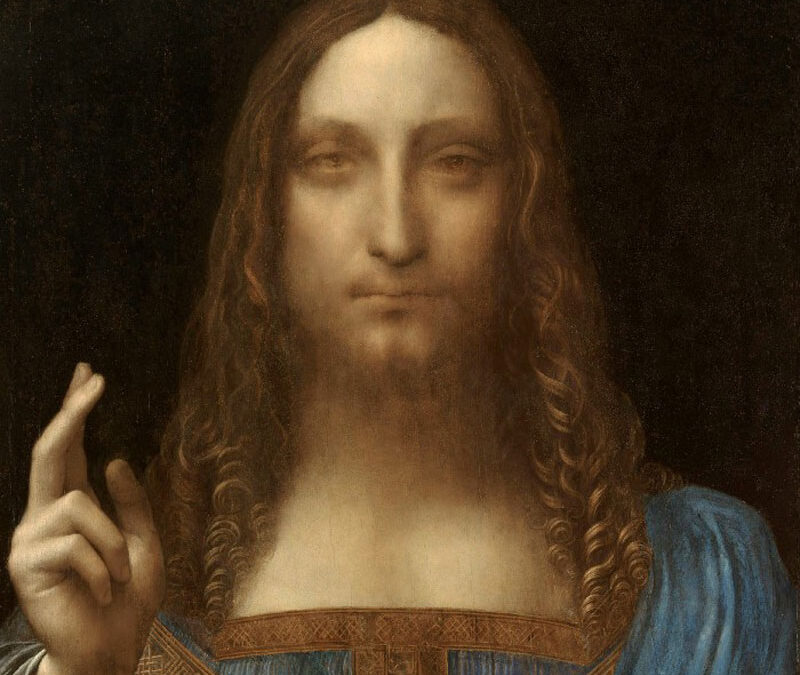

Leonardo da Vinci’s Salvator Mundi (“Saviour of the World”) was sold last year for $450 million. $450 million! Only sixty years earlier the painting sold for just $60. Can there be any reasonable comparison between valuing an artwork and valuing a business?

VALUE

A business is an investment in future cash flows, future profit. The present value of those future cash flows is the value of the business.

Art is an investment in the future value of the work, as people become wealthier their demand for high art increases.

Future cash flows in a business are uncertain, exposed to customer whims; the value of an artwork is susceptible to shifts in movement sentiment — contemporary art is currently outperforming impressionist art.

Comparisons

To value art, valuers often look at recent comparable transactions in works by the same artist and sales by similar artists. The valuer considers the size of the painting, the medium (paper or canvas) and the age of the comparable work.

A business may also be valued by looking at recent comparable transactions in the company or in a similar company. In considering the extent of the comparison, the business valuer compares factors like the business size, products and services, customers and markets.

Quality

A paintings intrinsic value is influenced by factors such as technique and colour application, but also the quality and condition of the wok. The value of a business is affected by the quality and condition of its assets and the quality of its earnings.

Talent and experience

The value of art is influenced by the artist’s background, qualifications, personality and creativity. Leonardo is regarded as a universal genius and one of the most diversely talented individuals ever to have lived.

The business may not possess a genius, but it can have talented, qualified and experienced people that will drive value.

Brand and uniqueness

The exponential drivers of an artwork’s value are the artists’ brand and its rarity. Leonardo is widely considered the most celebrated painter of all time and the Salvator Mundi was the first Da Vinci painting to appear in a public sale for 100 years.

Business value is driven by its unique competitive advantage, through its brand. The brand strengthens its ability to attract and retain customers, and so generate future cash.

PRICE

Price is not necessarily the same as value. Price is influenced by the vagaries of human behaviour.

Getting ready for market

Sir Francis Cook (no relation!) sold the Salvator Mundi in the 50’s for $60, it had been overpainted and was dark and gloomy. It was regarded as a mess and the work of one of Da Vinci’s followers rather than an original.

It was only because of painstaking restoration work over a few years that the painting was established to be Da Vinci’s, and the price rocketed.

A business may have to spend a few years getting its self-ready for market to get the best price; to ensure earnings are maximised, risks minimised and the business’s qualities shine through

Timing

Sales price is driven by timing, such as the liquidity in the market and economic conditions at that time. Salvator Mundi was sold in bursting art market and steaming economic climate.

Professional sales process

A higher price may be achieved in a well-run, competitive, sales process. Christie’s, the auctioneers, pulled out all the marketing stops for the Salvator Mundi, including a multi-city pre-sale tour. A healthy dose of hype also doesn’t go amiss.

Ego and emotion

Price is a function of motivation and momentum in the market. Price is driven by ego and emotions, “I have to have that picture at any price”. The buyer of the Mundi earned the distinction of having paid the highest sum ever for a piece of art.

SUMMARY

An investment in a business, like an investment in a painting, is based on a belief that the business will generate future returns. Earnings and business value, like artwork, are driven by the quality of the business, its talent pool, uniqueness and the strength of its brand.

Price is shaped by how ready the business is for sale, the timing of the deal, the professionalism of the sales process, and the ego and emotions of buyers.

1. Coate, Bronwyn, The economics of ridiculously expensive art, The Conversation, November 2017

2. Kamensky, Mikhail, Salvator Mundi, The Art Market As It Should Be, Art Decision, November 2017

3. Schneider, Tim, Why Would Anyone Pay $450 Million for the ‘Salvator Mundi’? Because They’re Not Buying the Painting, artnetnews, November 2017

4. The science behind valuing art, Ernst & Young, December 2017

5. Salvato Mundi, Wikipedia

Simon is a CA Business Valuation specialist, Chartered Accountant and a Certified Fraud Examiner. Simon specialises in providing valuation services. Prior to founding Lotus Amity, he was a Corporate Finance and Forensic Accounting partner with BDO Australia. Simon provides valuation services in disputes, for raising finance, for restructuring, transactions and for tax purposes.