by Simon Cook | Oct 27, 2020 | Business Valuation

The market share price of a listed public company represents the portfolio interest price. That is to say, the price an investor is prepared to buy or sell a small parcel of shares, typically less than 5% of the company. In takeovers of listed companies, an acquirer...

by Simon Cook | Sep 8, 2020 | Business Valuation

The value of a privately-held business maybe calculated using a discounted cash flow method or a capitalisation of earnings method; both methods require an estimate of the cost of capital. The cost of capital can be estimated using pricing from public markets. Shares,...

by Simon Cook | May 29, 2020 | Business Valuation

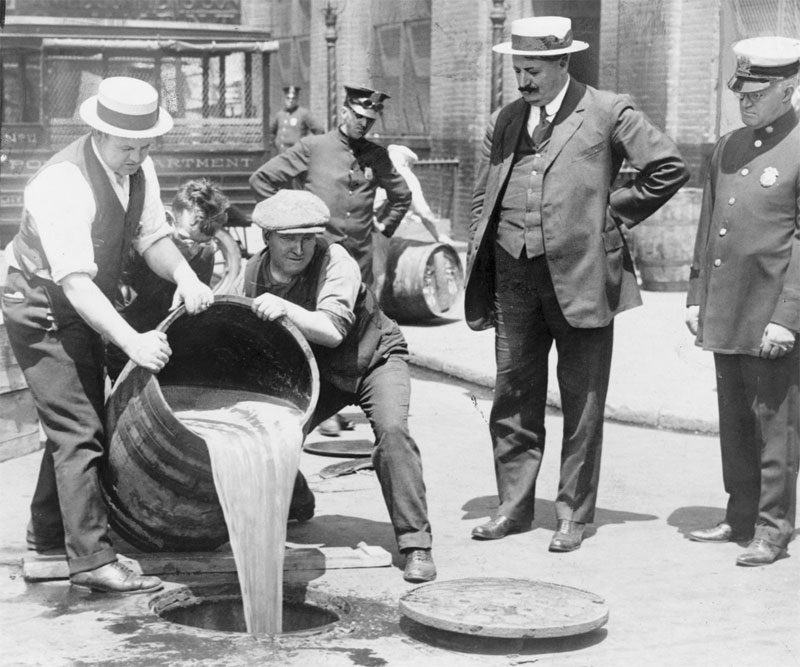

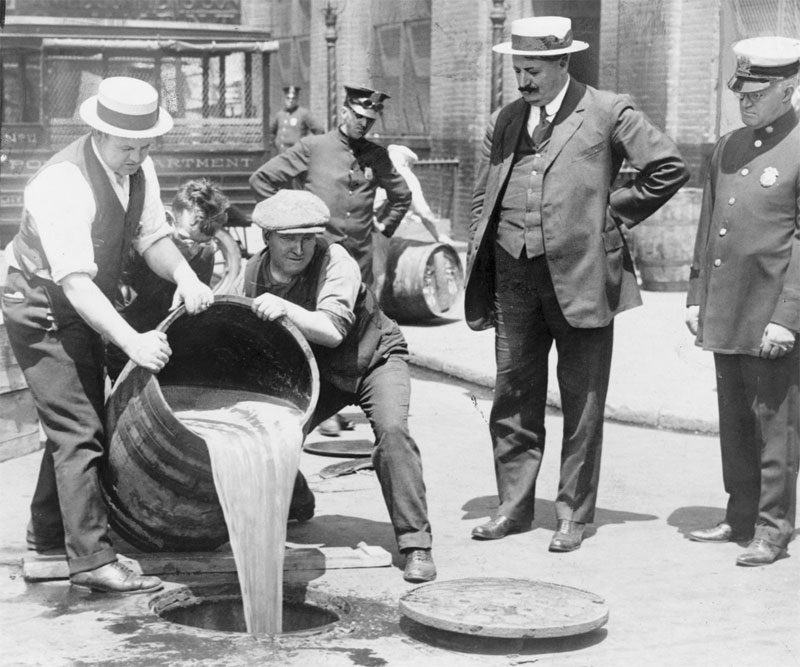

I wondered if I should be using the Capitalisation of Excess Earnings method to value a business? The method originated in 1920 in the US, from a Treasury Department memorandum and later update as an Internal Revenue Service (IRS) Revenue Ruling. During prohibition,...

by Simon Cook | Apr 22, 2019 | Business Valuation

The Pepper Private Capital report was recently released. I’ve saved you the trouble and ploughed through it! I personally wouldn’t want to rely on it for valuation inputs (its US based anyway) but it might be an interesting sanity check (or not!). These are the bits...

by Simon Cook | Feb 19, 2019 | Business Valuation

Risk-averse investors demand a higher rate of return on an average equity risk investment compared to a risk-free investment. The difference in return is the Equity Risk Premium (ERP). ERP is the price of risk. What, however, are the factors that influence the ERP?...

by Simon Cook | Feb 19, 2019 | Business Valuation

Often business valuers use a higher required equity return for a small business compared to a similar, but larger business. The difference in equity returns is the small-cap premium. It refers to the premium small capitalised businesses (a low market value) are...

Recent Comments