by Simon Cook | Feb 17, 2019 | Business Valuation

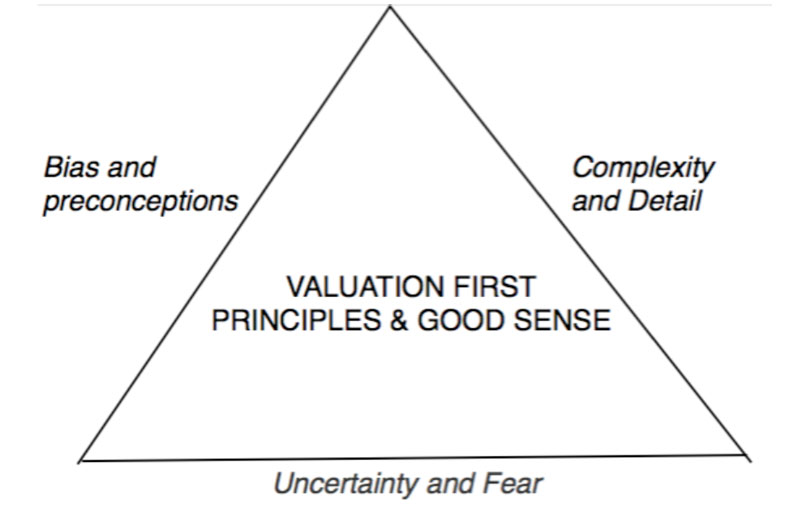

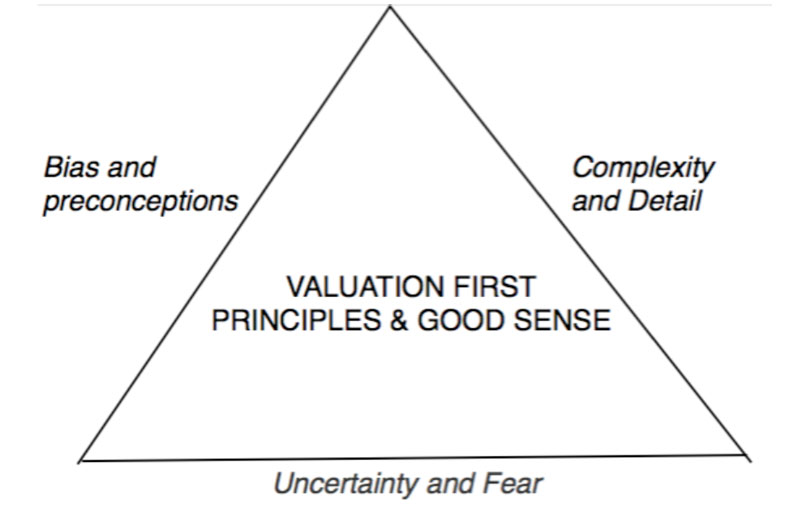

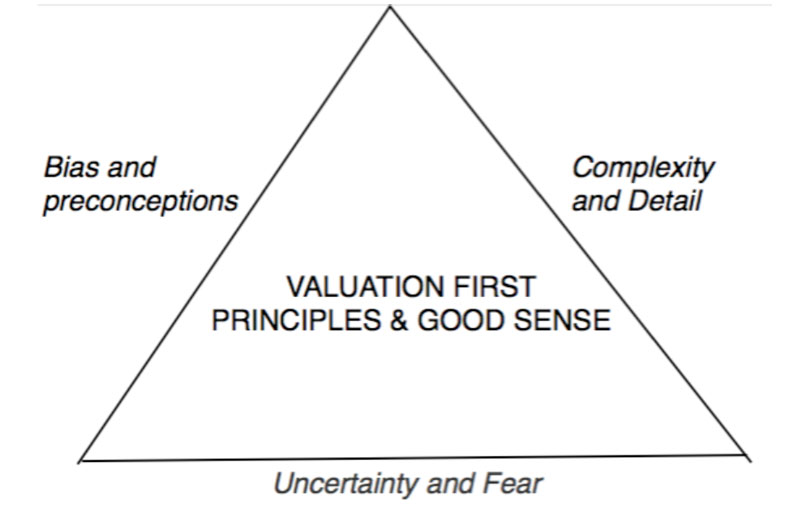

I like Professor Damodaran’s simple Bermuda triangle of valuations. According to the Professor, the three simple truths of valuation (the sides of the triangle) are: All valuations are biased. You just need to think about how you are biased and by how much. Be aware...

by Simon Cook | Nov 14, 2018 | Business Valuation

risk /rɪsk/ — a situation involving exposure to danger, from Italian risco “danger” Business value is a function of the future expected cash flows from the business and the risk attached to those cash flows. The value of a business is the present value of future cash...

by Simon Cook | Nov 3, 2018 | Business Valuation

Marketability discounts are often applied by business valuation experts to reflect the difficulty in selling shares in a private business compared to selling shares in a publically listed company. You can sell shares in a listed stock at the click of a button, with a...

by Simon Cook | Oct 25, 2018 | Business Valuation

The similarities between valuing and selling a business and valuing and selling art. Leonardo da Vinci’s Salvator Mundi (“Saviour of the World”) was sold last year for $450 million. $450 million! Only sixty years earlier the painting sold for just $60. Can there be...

by Simon Cook | Oct 24, 2018 | Business Valuation

An earnings multiple may be used to provide a guide to the valuation of a business. The relevant earnings base is multiplied by the earnings multiple to arrive at the business valuation. The earnings multiple reflects the risk attached to future earnings. The lower...

by Simon Cook | Oct 22, 2018 | Business Valuation

\ ˈek-ˌspərt — expert Having, involving, or displaying special skill or knowledge derived from training or experience. \ ˈˈe-və-dən(t)s — evidence Information drawn from personal testimony used to establish facts in a legal investigation or admissable as tesimony in a...

Recent Comments