Comparable analysis

Comparable analysis

When valuing a home, a real estate agent usually looks at comparable houses sold near-by. A similar process can be adopted in valuing a business. We look at similar businesses that have been sold or shares in similar companies that are traded. This is essentially the Market Approach.

Unlike an Income Approach that calculates the intrinsic value of the business, the Market Approach is essence is pricing the business.

Lotus Amity Approach

At Lotus Amity we often adoptelements ofthe two Market Approach methods as a corroborative approach to measure the appropriateness of the value derived under the Income Approach:

- the Guideline Publicly Traded Comparable Method (IVS 103, paragraph A10.09); and.

- the Comparable Transactions Method (IVS 103, paragraph A10.01).

We identify public companies and transactions with similarities to the subject business, as reported in the Thompson Reuters database.

We then extract metrics for those companies and transactions. Examples of metrics include revenue and earnings in the last twelve months and the forecast for the next twelve months.

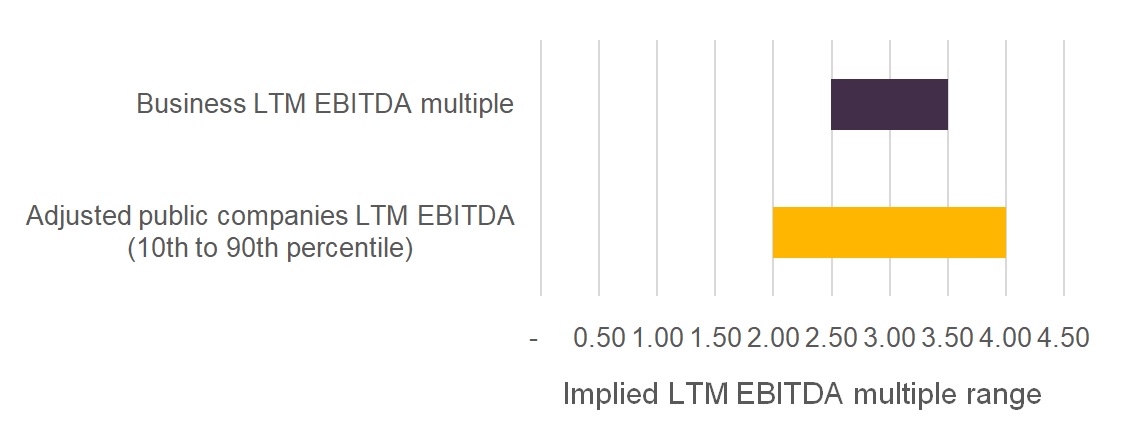

We then infer value multiples based on the observed metrics and the valuation of the companies at the valuation date or the transaction prices. Finally, we compare those inferred multiples to the inferred multiples for the subject business: