Discount Rate Modelling

- expected future cash flows; and

- the risk associated with those future cash flows

The discount rate reflects the risk associated with future cash flows. It is the rate of return that investors expect to receive to reflect the level of risk. Importantly, the discount rate must be consistent with the type of cash flow.

The discount rate effectively reduces the value of a future cash flow to a lower value today. The higher the discount rate the lower the value today

Developing a discount rate

The International Valuation Standards refer to the following as common methods for developing an appropriate discount rate (IVS 103, paragraph 20.31):

- Capital Asset Pricing Model (CAPM)

- Weighted-Average-Cost-of-Capital (WACC)

- Observed or inferred rates and yields

- Build-up-Methods

At Lotus Amity we often use an extension of the CAPM to estimate a cost of equity (the return required by shareholders). We then use the WACC (which includes the return to debt holders) to calculate the discount rate applicable for the entire business.

IVS also state that a valuer should consider corroborative analysis to assess the appropriateness of a discount rate. At Lotus Amity our corroborative analysis includes comparing the implied multiples from the Income Approach with guideline company market multiples and or transaction multiples (IVS 103, paragraph 20.32 (c)).

Return on equity calculation

Modern Portfolio Theory (MPT) assumes that investors are risk averse. Investors will only accept increased risk in an investment portfolio if compensated by higher returns.

MPT is an extension of diversification. Investors can reduce overall risk by investing in a variety, a portfolio, of different assets. Consequently, according to MPT, the risk and return of an asset should not be assessed by itself but by how it contributes to the overall risk of the portfolio.

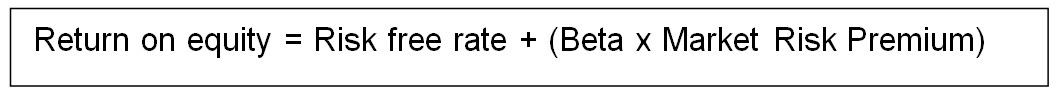

CAPM is based on MPT. CAPM describes the relationship between the expected return and risk of investing in an asset. It estimates the expected return as equal to the risk-free return plus a risk premium.

CAPM formula

Return on equity inputs

Lotus Amity often uses the Commonwealth Government ten-year bond yield as a measure of the risk-free rate. This assumes that nominal cash flows are used, i.e.the cash flows reflect inflation. Sometimes, the subject asset may have a shorter life and a shorter bond-yield is appropriate. Occasionally, real cash flows (adjusted for inflation) are required and so the Commonwealth Government indexed ten-year bond yield is used.

To estimate the equity risk premium, we often refer to historical studies, such as the worldwide equity risk premium studies carried out by Griffiths University, and forward equity risk premiums in the market.

There are two key types of financial risk: market risk and firm risk. Market Risk is the vulnerability to events, such as changes in economic conditions, which affect all market returns. Firm Risk is the vulnerability to events in which only specific industries are exposed.

Importantly, CAPM only estimates the rate of return of an asset in relation to a well-diversified portfolio. Beta only reflects the extend a company’s performance can be explained by the market’s performance. Consequently, CAPM only reflects Market Risk.

At Lotus Amity we principally value privately held businesses. Investor owners in privately held businesses often do not have the luxury of the business being part of a diversified portfolio. All the owner’s eggs may be in the one business basket. The owner investors are exposed to both Market Risk and Firm Risk.

Consequently, at Lotus Amity we adjust beta to reflect not only Market Risk but also Firm Risk. This adjusted beta reflects the volatility (standard deviation)of the total returns of a company compared to the volatility in the returns of the market.

Discount rate

Companies raise finance from a variety of sources which are either equity-based, debt based or a hybrid of the two. A company’s cost of capital, the discount rate, is the combined rate of the return required by equity holders and debt holders.

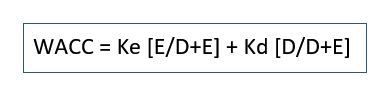

At Lotus Amity we calculate a company’s cost of capital (the discount rate) by weighting the equity and debt returns according to the respective amounts of equity and debt. This is known as the Weighted Average Cost of Capital (WACC) and is calculated using the equation below. Where Ke is the cost of equity, Kd the cost of debt, E the value of equity and D the value of debt. The cost of debt is the after-tax cost of debt.