Liquidity Modelling

At Lotus Amity we typically model a cost of capital (discount rate) using pricing from public markets. However, we principally value privately held businesses. There is a fundamental difference between shares in a public company and a privately held company. An investor in a public company can sell shares instantaneously, an investor in a private business must first find a buyer.

Therefore, once we have built up a cost of capital derived from public pricing,we make an adjustment to reflect the comparative lack of liquidity in the privately held company.

Put option model

At Lotus Amity we often refer to a put option model as basis for estimating liquidity. This is on the assumption that the main driver of illiquidity is the risk that the price of the business may fall while the investor waits for a buyer or the business becomes unsaleable.

A put option is a contract giving the owner the right, but not the obligation, to sell an underlying security at a pre-determined price (the strike price) within a specified time frame.

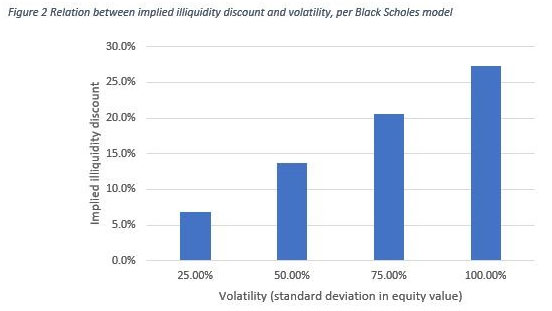

The price of the put option depends on the volatility of a stock’s market price, the strike price, the time frame and the risk-free rate. As volatility increases, all other factors remaining constant, the price of the put option increases and so the implied illiquidity discount increases.

If it takes time for an investor to sell a privately held business, then the value of liquidity is the value of a put option allowing an investor to sell the business at the time of close, at the value at the listing date.

In calculating illiquidity discounts Shannon Pratt refers Business Broker surveys which report that the average time to sell a business is approximately six months from listing to closing (3).

As an example, using a Black-Scholes option pricing and assuming: the stock price equal to the strike price, an expiry period of six months, no dividends, a risk-free rate of 1%, standard deviation in equity value of between 25% and 100%; then the implied illiquidity discount range is between 6.8% and 27.3%, as illustrated in the figure below.